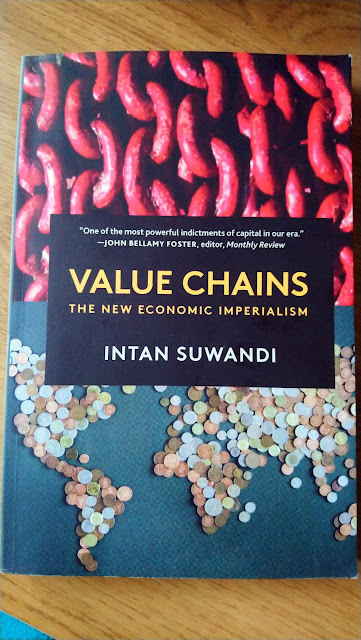

Review of Intan Suwandi's Value Chains The New Economic Imperialism

It is not exactly true that multinational production’s profits and value are mostly appropriated by the North. At least not in relative terms. As we can see here in the following data, the UK or Germany surpass everyone else in the absolute amount of value added created through their multinational investments all over the world.

|

| Source: U.S. Department of Commerce, Bureau of Economic Analysis |

But the net income they receive as a share of the whole value-added created by all of their affiliates and multinational investments, is not always bigger than the affiliates, nor is bigger than “Third World” economies comparatively.

| Germany | 20% |

| United Kingdom | 63% |

| Turkey | 7% |

| Brazil | 17% |

| South Africa | 16% |

| China | 37% |

| India | 14% |

| Korea | 26% |

| France | 11% |

| Norway | 69% |

| Saudi Arabia | 44% |

The only countries which appropriate the majority of value out of their multinational affiliates, are the UK and Norway. Germany and France leave 80% and 89% of the value-added created, outside of their parent company’s countries.

Here we see the data for US multinationals, in terms of direct investment income and financial outflow transactions from US parent companies to their foreign affiliates, where the US spends in absolute terms, almost the same amount of money it receives as income, or even less at the beginning of the century.

|

| Source: U.S. Department of Commerce, Bureau of Economic Analysis |

Both John Smith and Intan Suwandi advance the argument that cheaper labor costs in the South augment exploitation, and so they create more surplus value which is then appropriated by multinational capital. They both affirm the Global South is becoming the locus of industrial multinational production, due to lower labor costs, higher exploitation rates, etc. And they both affirm this argument is in support of the persistence of imperialism. The problem is they don’t seem to notice their argument goes against classical imperialism: in classical imperialism, the locus of industrial production, capital goods-production, capital-intensive production, etc, were the advanced countries themselves. Imperialism was based, as anyone can realize by themselves, on the industrial-agricultural divide in the world market: advanced and powerful societies and economies were industrial, while the poor and backwards were based on the primary sector. Now these authors affirm the opposite, and pretend nothing needs to be explained, or that nothing has changed. We don’t deny there’s an imperialism today, but it certainly isn’t classical imperialism. Classical imperialism, and all the classic works devoted to the subject, are framed within monopoly capitalism. Imperialism has suffered the experience of going through late capitalism, not monopoly capitalism, and there’s no classical imperialism text or book able to witness the developments of late capitalism. This has changed the face of imperialism; it hasn’t erased it nor make it disappear, but it has make profound changes.

Of course, labors costs are lower in the peripheries. But they have been since forever. Then why didn’t the peripheries became the advanced countries instead of the Triad? Why the Triad was, indeed, way more advanced than the so called “Third World”, while having a bigger share of labor costs and wages? And how this situation was reversed or inverted, to the point where both these authors acknowledge, an industrialization of the South which is at the opposite end of the industrial-agricultural divide of classical imperialism? Do these authors know that the post-war boom, which is the biggest productivity growth in any period of capitalism, was mainly created within societies with bigger wages and labor costs? These authors seem to think we just need to take a look at labor costs, and voilà: we can assume bigger surplus value because of the exploitation rates. But what about advanced countries creating the post-war boom? How is that surplus value, and the biggest creation of surplus value capitalism has ever seen, was created within societies which have bigger wages and bigger labor costs? Is it so simple as to just taking a look at labor costs and that’s it?

Lower labor costs are just one variable. It seems clear that countries and societies with bigger wages and labor costs were able to surpass countries with lower wages, thanks to productivity and the internal market (here). Those countries are, obviously, the advanced countries. And this takes us to other variables like innovation and a bigger share of labor as opposed to constant capital, which elevates productivity, profits and surplus value, even if there are bigger wages or labor costs. The point is that this situation ceased to be, when the post-war boom reached it’s limit, and the mass of accumulation (as in the law of accumulation of Capital Vol. 1) stopped offsetting the growth in constant capital, and the growth of constant capital started to turn into the long fall of the profit rate that we all know about today. This is the historical element which produces the turn where lower labor costs and lower wages, turn into something more profitable for capitalism, than higher productivity with bigger wages in the advanced countries of the Triad. The law of accumulation, which is centered around mass instead of rates, is very important: the Triad still has an advantage in terms of the mass of accumulation, which allows them to offset the growth in organic composition. Is not only that the absolute mass grows more than the growth in constant capital, but that this situation allows capitalists to lower unitary prices, allows them to have a bigger manouvre in terms of how much to lower unitary prices, and it also cheapens or devalues constant capital itself (as explained in the counterdencies to the fall in the profit rate in Capital Vol. 3). This is important because it means that higher rates of exploitation and higher rates of profit in the “Third World” or the Global South, or lower labors costs and lower wages, were based through the use of expensive constant capital. Not expensive nominally, as in their price (which was low because this was backwards technology), but expensive in the sense that its backwardness didn’t allow them to work based on productivity and innovation (Patnaik), but conforming themselves to the exploitation rate which Smith and Suwandi point out.

This has changed through multinationals, who have started to innovate and update constant capital in the South, just like Smith and Suwandi agree: the Triad is getting deindustrialized, against any classical imperialism, and it is the Global South which now concentrates world industries. Suwandi and Smith are right though: these recent phenomena which contradict classical imperialism, also benefit the Triad; it is the Triad which has not only regional multinationals, but worldwide multinationals. That means the law of accumulation still gives them a huge advantage, because of the mass of accumulation offsetting any organic composition growth. That means this inversion of roles between industrial and agricultural countries, even if it contradicts classical imperialism, benefits the advanced and powerful countries of the Triad. But at the same time, productivity is growing more in the South, profits are growing more as well, revenues and growth rates are dominated by low and middle income countries instead of the high income ones. This cannot be denied, precisely because that’s what the arguments for imperialism themselves acknowledge: a bigger exploitation rate in the “Third World”, a concentration of industrial production in the “Third World” and not in the Triad anymore, etc. But we’re not with Harvey. The Triad isn’t decreasing it’s influence and power: it’s getting joined by a new layer of capitalists, including in the poorest regions of the world. Millionaires and billionaires keep growing, specially in low income countries, because they’re getting to compete and join at the same time, through the multinational investment and production enjoyed by the Triad. It’s a class differentiation process happening because of local and “Third World” bourgeoise getting to access portfolio investment (equity stocks, bonds, funds), Mergers&Acquisitions, etc. That’s why the GNI rate is growing more on middle income and low income countries: not only value-added created domestically, but the foreign return and income on financial and direct investment abroad. At the same time, multinationals entering the South help improving productivity, as Suwandi admits. Those are spillovers from multinationals to host economies, which help local and poor countries update themselves, and leave behind their model based on exploitation rates and a backwards and frankly static investment in constant capital, so even having bigger exploitation rates and profit rates than the North, didn’t help in reducing necessary labour as opposed to surplus labour through productivity changes (Patnaik). This is the stagnation of underdevelopment. And GNI, productivity and industrial value-added numbers growing, mean the end of that period for the “Third World”. The Triad is not going away, but is being joined by a new cadre, which only will intensify competition and frictions, as well as juicy businesses for all involved. Imperialism is not a geographical category, and every country and nation-state is imperialist, or a node-link which connects other bourgeois classes, in order to enforce the empire upon their respective peoples and workers. The nodes which connect this imperialist network, are the same which enrich the Triad over underdeveloped countries, and which enrich the southern smaller partners in business from the South, over their own southern citizens and workers.

.png)